| Page 2 |

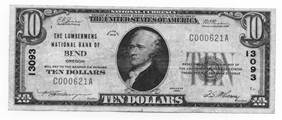

| (Continued from page 1) while grade is important, rarity is increasingly more significant, especially for notes with a census less than ten. For notes that rare, demand powerfully outstrips supply. Consider that only 32 or so small size notes exist have “Brooklyn.” And only 6 for Brigham City, UT. A handful of buyers creates a frenzied market. A few years ago, most notes sold for relatively little above face value. This changed as collector demand increased. But demand still is not close to its potential—not by a long shot. Along with those striving to get one note from each county in a state, or each state in the Union, many non-collectors simply want a note from their home town, or town from or near where parents, siblings, friends or spouses are from. National Bank notes are outstanding gifts. Unlike coins which of |

| Yes, if any of the following conditions/situations apply: ¨ You have “junk” coins you wish to trade for rarities. ¨ Your coin accumulation is heavy, bulky, and you wish to consolidate it or turn it to cash. ¨ You need cash. ¨ Your age or condition requires simplifying assets to make them liquid. ¨ You overpaid for coins and you could use a tax loss. ¨ You inherited a collection you must sell or split among heirs. ¨ You have lost interest in coins. ¨ You want to upgrade your collection. |

| Should I Sell in an “Up” Market? |

| Rare Date Gold (cont’) |

| Small Size National Bank Notes (cont’) |

| Customized Numismatic Portfolios |

|

understand than rarities and is available in any dollar quantity or denomination. Generic gold has huge appeal to investors. Not surprisingly, I am now seeing a surge in purchases by investment advisors and financial planners. Everything is in place for an explosive market in generic gold. Therefore, for the first time since founding CNP in 1991, I now recommend a strong buy in generic gold. Fortunately, a type set of high grade generic gold can also be terrific for the collector in all of us. Talk about the best of both worlds!! |

| (Continued from page 1) gold is far less than modern gold, but demand now is weak. A sudden increase in demand could quickly dry up supply, causing sharp price increases. Since the last big generic gold price surge in the late ’80’s, the numismatic market has quintupled. Price information is readily available, sight unseen trading mechanisms are secure and easy, spreads are low -often under 10% - and confidence in coin quality as a result of PCGS and NGC grading have contributed to a secure, fluid market. Priced close to gold bullion, generic gold acts like expensive bullion. It gets more upside “kick,” yet resists price drops better than bullion. It is easier to

|

| Rare Coin Report is written and published by Lawrence D. Goldberg, owner of Customized Numismatic Portfolios (c) Oct, 2006 All Rights Reserved Please feel free to call toll free with your comments and questions at: 800 334-3325 Fax: 818 557-0902 e-mail: nofreelunch@earthlink.net

|

| I need coins now. Highest Prices Paid. Call (800) 334-3325 |